Embracing Python for Career Advancement in FinTech

A LinkedIn report from September 2022 highlights a significant shift in job skill sets, with a change of about 25% since 2015 and an expected shift of 41% by 2025. This dynamic landscape presents both a challenge and an opportunity, particularly for those in the FinTech sector. Learning Python, for instance, emerges as a strategic move for those looking to secure their future in the industry.

The Changing Landscape of Job Skills

The rapid evolution of job requirements necessitates a proactive approach to learning. For professionals who have been in the same role for an extended period or those who feel their growth has plateaued, it’s crucial to keep skills sharp and continuously acquire new ones. This ongoing development is not just about keeping up with industry trends; it’s about staying ahead and enhancing your career trajectory.

Employers today value a mix of soft and hard skills. Soft skills like communication, empathy, and negotiation are increasingly important and are viewed by 61% of professionals as equally important as technical skills. However, when focusing on hard skills, which directly impact salary potential and job opportunities, learning programming languages such as Python stands out as particularly beneficial.

Why Python?

Python, developed in the 1990s by Guido van Rossum and named after the Monty Python’s Flying Circus TV show, is renowned for its straightforward syntax and readability, making it an excellent choice for beginners. Its simplicity does not detract from its power; Python is a favorite among major tech companies such as Intel, IBM, Netflix, Facebook, Spotify, and notably, it plays a significant role in the operations of YouTube and Google.

The language’s growing adoption across the tech industry has made it the third most in-demand programming language, according to a 2022 Statista survey. GitHub further supports this data by ranking Python as the second most-used programming language on their platform, with an annual growth of over 22% in usage.

Python’s Role in FinTech and Finance

For those in the FinTech, finance, and neobanking sectors, Python’s appeal lies in its versatility and capabilities. It excels in areas crucial to financial technologies, including data analysis, web development, machine learning, automation, and blockchain technology. These areas are pivotal for companies looking to innovate and streamline their operations, making Python skills highly sought after.

Moreover, Python is supported by a robust community of developers who contribute to an extensive range of open-source projects, libraries, and frameworks. This community support means that resources for learning and problem-solving are readily available, making it easier to overcome challenges and improve your proficiency in the language.

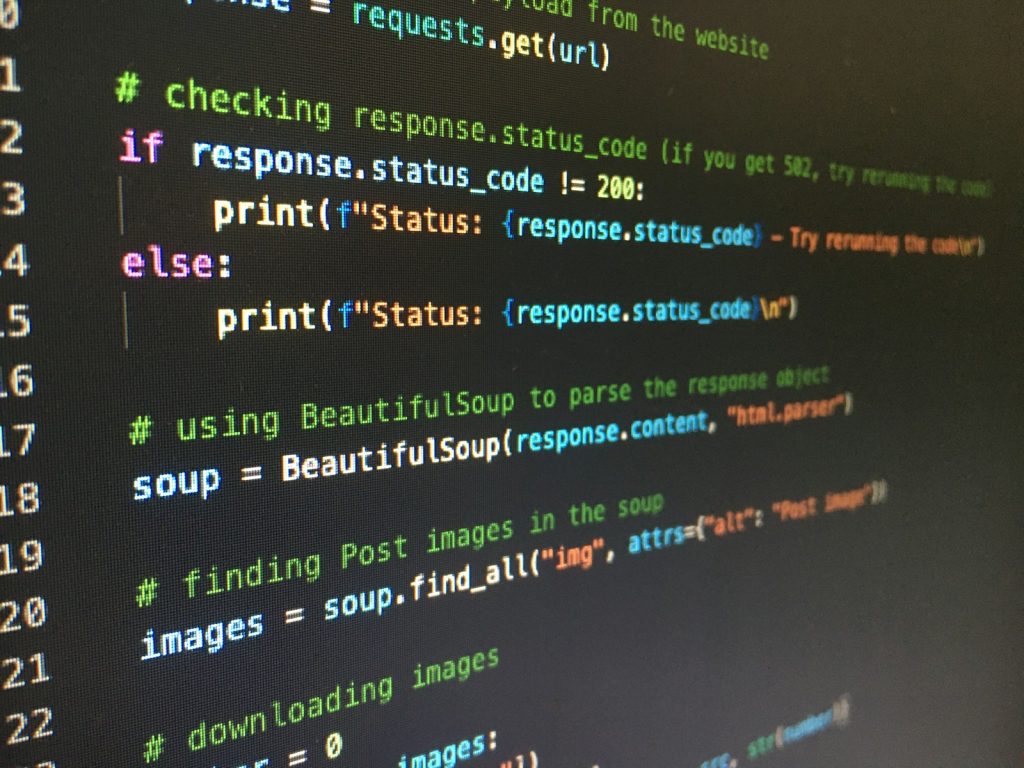

Learning Python

One of the most accessible ways to start learning Python is through Massive Open Online Courses (MOOCs) platforms like Udemy or Coursera. Beginners can understand the basics within a few weeks, which is invaluable for grasping more complex technical topics. For those looking to make a career switch or advance within their current field, dedicating up to 12 months of study can result in becoming job-ready with Python.

This investment in time can significantly pay off. The ability to analyze data more effectively, automate routine tasks, develop secure web applications, and implement machine learning algorithms are just a few of the competitive advantages that Python proficiency can bring. As the FinTech industry continues to grow and integrate more advanced technologies, having a solid understanding of Python will not only enhance your resume but also provide you with the tools to innovate and lead in your field.